Contents:

The focus of the ban is on buying and selling the same currency pair at the same or different strike prices. The CFTC has established trading restrictions for Forex traders. Traders and investors of all stripes use hedging to protect their positions against adverse market fluctuations. A hedging strategy involves opening a second position whose price is likely to have a negative correlation with the primary asset being held. This means that if the primary asset’s price moves adversely, the second position will react accordingly, thereby offsetting those losses. Hedging with forex is a strategy used to protect one’s position in a currency pair from an adverse move.

For example, when someone buys fire insurance, they’re protecting, or hedging, their property against possible fire in the future. The practice isn’t only common among trading institutions; ordinary people do the same thing when they try to avoid losing their money due to reductions in currencies by buying gold, for instance. Ezekiel is considered as one of the top forex traders around who actually care about giving back to the community. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms. Hedging strategies also save time, allowing brokers to regulate their portfolios with daily volatility in financial markets.

Can you lose money hedging?

A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. In finance, a spread usually refers to the difference between two prices of a security or asset, or between two similar assets. Full BioSuzanne is a content marketer, writer, and fact-checker.

- The simple strategy to get out of hedge forex is to use a stop loss.

- Hedging forex is a compound technique and behooves a lot of arrangement.

- Traders use these risks for there future move and can easily protect themselves from a big loss.

- Some even consider it necessary because everyone would want to protect their funds from market volatility.

- Most international brokers typically cater to hedging strategies as brokers earn twice the spread from hedgers than regular traders.

- Many traders argue that this rule will limit their access to market opportunities and make European cities less attractive as currency-trading hubs.

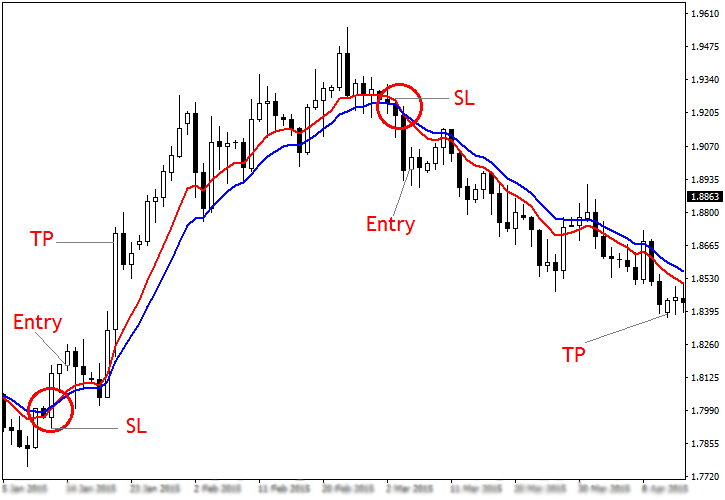

With this in mind, it does give you a lot of flexibility to optimize your trading. Let’s say a Forex trader decides to purchase the GBP/USD currency pair using a “buy” order, then creates a “sell” order to profit from the potential rise or fall in price. As a result, the trader is hedging against any arising from possible price movement against his long position, which is more likely to reduce his losses.

How to Get Around FIFO and Hedging Forex Trades With a US Broker

Yes, Forex hedging is profitable because it helps you counteract the risks of losing money in a market position. It’s a risk-minimization strategy that protects an open Forex position by buying the opposite side of the same trade. Has put several restrictions on forex traders and a key restriction among them is to hedge a position on the same currency pair. This is identical to placing an order to buy 20 pips above the current price and to place a sell order 20 pips below it. In either case, you’ll make no gain or loss if the market stays between -20 pips and +20 pips from entry. In either case the profits come when the market goes more than 20 pips in one direction, but with the same risk that if the market turns back around you are subject to loss.

IBFX and FXDD has developed a way to accommodate for FIFO and hedging which they call a back office solution. It doesn’t work for every type of fifo/hedging problem but I understand that it does work for some trading systems. But in reality it would show up as losses on our P/L when it could have been a profit.

Is Forex Illegal in Bangladesh

However, hedging against Forex trading is considered illegal in the United States. It is because it involves buying and selling currency pairs at the same or different strike prices. There is an ample risk mitigation strategy, that forex brokers can use to reduce their potential losses, and hedging is the most popular.

5 Best Forex Brokers in Pakistan March, 2023 – Is Forex legal in … – DailyForex.com

5 Best Forex Brokers in Pakistan March, 2023 – Is Forex legal in ….

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

But if an inexperienced user uss it and have no k knowledge about it then this will definitely give loss. It is important to understand that hedge forex is not a strategy to make a profit. It is a way to protect your trades from losses by cutting risk.

Strategy Two

A put option is used when trading shares on a stock exchange. By executing a put option, the trader is hedging the stock against adverse movements. Hedging is a unique concept in the financial markets, which allows an investor to moderate his risks against market volatility. Hedge definition describes an investment strategy used by traders to protect their investments from risks of heavy price fluctuations in an asset.

Instead of closing your order, you could hedge your position by buying a put option that gives you the right to sell the pair if the price falls below a certain level. This way, you could still make a profit even though your predictions are wrong because your funds are protected. Up to now, we’ve discussed direct hedging and indirect hedging as an advanced strategy used in forex trading.

Therefore, there are restrictions that CFTC made for Forex traders to manage the law of buying and selling correctly. In other places such as Europe, Asia, or Australia, Forex hedging is a legal activity, and you can use a Forex hedging robot or whatever else to implement this to your trading activities. Forex hedging is the method of strategically introducing supplementary positions to safeguard against disadvantageous development in the foreign exchange market. The maneuver decreases losses by entering into one or more currency trades that balance the existing position. The forex hedging strategy is limited for both profit and loss. If the experienced traders ise it for their trading then it will be beneficial fot them.

These floating is hedging in forex illegals can fluctuate depending on the movements of the forex market. Any sudden news can impact your fundamental as well as technical analysis. All of the information and materials available on PublicFinanceInternational.org is not financial advice and is for general informational purposes only. Nor PublicFinanceInternational or any of our affiliates makes any recommendation or implies any action based on the information we proved to you. We don’t make any solicitation or recommendation to take any action or trade or invest in any financial instrument, asset, or commodity.

Hedging refers to a trading strategy that aims to offset potential losses by taking both long and short positions in the same currency pair or in related currency pairs. Most Forex brokers support hedging by allowing traders to open both long and short positions in the same currency pair or in related currency pairs. The primary methods of hedging currency trades are spot contracts, foreign currency options and currency futures. Spot contracts are the run-of-the-mill trades made by retail forex traders.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content https://1investing.in/ for financial brands. Brokers in the UK, Australia, Asia, Europe, and South America often allow hedging. Be careful not to spin out of control on your open positions if you feel the need to hedge your hedged positions and end up with too many layers.

The History of Options Contracts – Investopedia

The History of Options Contracts.

Posted: Sat, 25 Mar 2017 16:15:30 GMT [source]

This means that you are selling pounds and buying dollars, which reduces your exposure to GBP. Since you are short USD, this offsets your other positions well. These two positions then offset each other, canceling all losses or gains.